Is Fliff Legal in the State of New York?

Fliff, the highly anticipated Sweepstakes gaming platform, has been creating quite a stir among gaming enthusiasts across the United States. With its unique blend of social betting and real cash prizes, Fliff has captured the attention of players looking for an exciting and potentially rewarding gaming experience.

As the platform continues to gain popularity, many players in New York are wondering whether Fliff is legal in their state and how they can get in on the action.

Is Fliff Legal in New York?

The good news for New Yorkers is that Fliff social sportsbook is indeed legal in their state. The platform operates within the legal framework of Sweepstakes, ensuring compliance with New York’s gaming regulations.

This means that players in New York can enjoy the thrills of Fliff without any legal concerns, as long as they meet the minimum age requirement and follow the platform’s terms and conditions.

Fliff Legal New York

How Does Fliff Work?

Fliff is a social betting platform that operates on the basis of Sweepstakes. Players can engage in various betting activities, such as predicting the outcomes of sporting events, participating in fantasy leagues, or playing casino-style games.

What sets Fliff apart from traditional gambling platforms is that it uses a Sweepstakes model, which allows players to win real cash prizes without risking their own money.

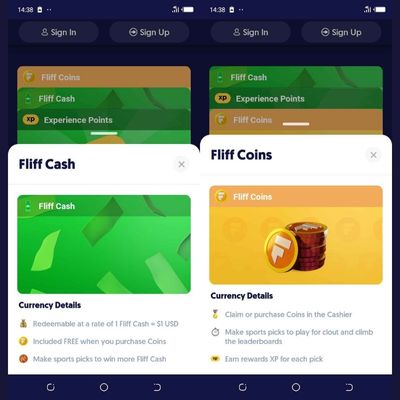

To participate in Fliff, players purchase a virtual currency called Fliff Coins. These coins can be used to enter contests and place bets. The other virtual currency, Fliff Cash, allows players to win real cash prizes. The prize pools are generated from the revenue earned by Fliff, ensuring that the platform remains compliant with Sweepstakes laws.

It’s important to note that while Fliff operates with Sweepstakes, winning real cash and redeeming it requires players to pay additional taxes. This is a standard practice for any form of gambling winnings, and players should be aware of their tax obligations before participating in Fliff.

Fliff Virtual Currencies

Taxes on Fliff Winnings

When a player wins a cash prize on Fliff and decides to redeem it, they are required to pay taxes on their winnings. The amount of tax to be paid depends on the sum of the winnings acquired by the player. This is in line with the tax regulations set by the Internal Revenue Service (IRS) for gambling winnings.

It’s crucial for players to keep accurate records of their winnings and to report them on their tax returns. Failure to do so can result in penalties and legal consequences. Fliff provides players with the necessary documentation, such as W-2G forms, to assist them in properly reporting their winnings to the IRS.

Taxes in The State of New York

In the state of New York, the tax rate on gambling winnings varies depending on the amount won. For winnings up to $5,000, the tax rate is 8.82%. For winnings between $5,000 and $25,000, the tax rate is 12.7%. For winnings over $25,000, the tax rate is 13.3%.

Conclusion

Fliff is a legal Sweepstakes gaming platform in New York that offers players the opportunity to win real cash prizes. However, players should be aware that redeeming cash prizes requires paying taxes on the winnings, with the tax rate in New York varying depending on the amount won. As with any form of gambling, it’s important to play responsibly and within one’s means.

In 2005, Tsvetan Tarpov began his academic journey, dedicating four years to studying Law in the sea capital of Bulgaria - Varna. Upon completion, he shifted his focus to Plovdiv, spending another four years immersed in the study of International Relations. This solid educational foundation, especially his exposure to Law, sharpened his eye for detail.