Is Fliff Legal in Texas?

Fliff, a social betting platform operating under the sweepstakes model, is a legal alternative for sports enthusiasts in Texas. Despite the state’s current stance on sports wagering, Fliff offers a unique opportunity for users to bet on games using Gold Coins (Fliff Coins) and Sweeps Coins (Fliff Cash). This article explores the legality of Fliff in Texas, its sweepstakes rules, virtual currencies, and the current state of sports betting legislation in the Lone Star State.

Is Fliff Legal in Texas State?

The short answer to this question is yes. Despite the fact that sports wagering is still not legal in the state of Texas, Fliff operates under the sweepstakes model. This puts it in a unique position and helps it comply with Texan regulations. Here are more details about the subject.

How does Fliff work?

Fliff is a social betting platform that only promotes sweepstakes-based gaming. What that means is, you can bet on games on the Fliff app using their Gold Coins and Sweeps Coins.

Sweepstakes casinos are totally legitimate businesses throughout the United States. Bear in mind, though, that if you predict correctly the outcome of a sports game and win a monetary prize, you are still required to pay taxes.

Fliff Mobile App Website

Taxes on Fliff Wins

If the amount of real money the player withdraws from the communal betting platform is more than $600, they are required to pay taxes on the entire sum. This applies to any amount of money that has been deposited on Fliff.

As an example, if a bettor deposits $700 and accumulates $850 overall through wins, they must pay taxes on the whole sum of $850, not just the profit of $150.

How is the tax calculated?

Regardless of the amount of real money that has been won, generally the IRS will tax around 24% of the winnings from the payout.

Does Fliff report winning to the IRS?

Every betting organization in the US is legally obligated to report any winnings that occur on their platform. It doesn’t matter whether they are sweepstakes or regular sports betting websites.

Whenever a player on Fliff wins a minimum amount of $600, the app will make sure to send them and the IRS a tax form before withdrawing it. Typically it is a W-2G form. You can learn more about it on the IRS website in the references below.

Fliff App Interface

The Sweepstakes Model

The pros of the sweepstakes rules make Fliff accessible for everyone 18 and older in almost all states, including Texas. Thus the lack of need for a sports betting license helps the platform reach many more people across the country.

Additionally, sweepstakes apps like Fliff implement the use of play-for-fun chips. In this case, they are called Fliff Coins. This removes the requirement for real money deposits on the part of the users. It also makes the betting app safe and fun without risking your own money.

- Note: Washington is the only state that prohibits Fliff. In Alabama, Georgia, Iowa, Indiana, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Ohio, and South Carolina players are allowed only to use Fliff Coins and can’t win real cash prizes.

Fliff App Store

The Sweepstakes Rules

No need to pay upfront – the most important thing to remember about Fliff is that any new player is not required to pay any real money to participate in the betting.

Chances of winning do not increase if a bettor spends real cash.

You must be a legal resident of the state of Texas and be 18 years old and above to play.

- Receiving Fliff Cash – there are several options to collect free Fliff Cash: through promotional bonuses; getting bonus Cash by purchasing Fliff Coins; participating in social media contests ( Instagram, TikTok and X); and mail-in requests.

- How to use Fliff Cash – it can be used to play sweepstakes games on the sweepstakes app. You can also redeem it for real money and other prizes within the rules, established by Fliff.

- Winner verification – before receiving a prize, every winner has to sign and return an eligibility declaration and liability/publicity release.

- Fliff reserves its right to cancel a payout – In case participants fail to follow the sweepstakes rules or can’t be contacted, this will lead to a forfeiture of the prize.

For further details on the subjects of rules and legibility, check out their comprehensive T&C and Sweepstakes Rules websites.

Sweepstakes Mode Fliff Sportsbook App

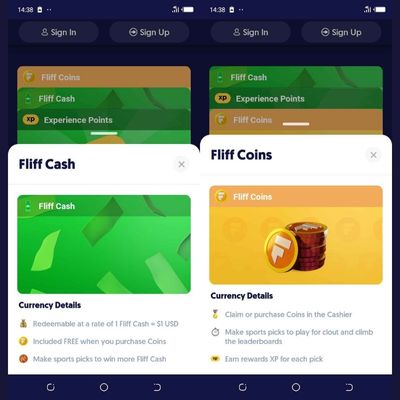

Fliff Coins

Fliff Coins can be used in betting games. Playing with this currency gives the chance of winning XP and additional Fliff Coins.

Experience points (XP)

Experience Points (XP) is what differentiates Fliff from other sportsbooks. Bettors receive XP by completing certain activities (challenges, making picks, purchasing bundles, or inviting friends.)

The more XP you have, the higher you will be placed on the Fliff leaderboards, which gives you bragging rights in front of fellow bettors. The Cashier is where you can use your Experience for buying Fliff Coin bundles or Gift Cards.

Fliff Cash

Fliff Cash represents the same value as real money. That means, if you have 5 Fliff Cash, it’s equivalent to $5. When a customer uses this sweepstakes currency to play, they have the option to withdraw any amount they wish or exchange it for prizes. Fliff Cash cannot be bought with real money. It can only be earned with bonuses, which we will be listed just below.

Virtual Currencies Fliff

Why is Sports Betting not Legal in Texas?

At the time of writing this article, sports betting is not legal in the state of Texas. During this year’s session of the House of Representatives, the sports wagering bill HB 1942 was proposed. The Senate, however, did not consider it. This has stopped the legislative efforts until at least 2025 when the next session will take place.

Alternative Option for Online Sports Wagering in Texas

For any sports betting enthusiast in Texas, looking to participate in a fun and safe environment, Fliff offers the perfect choice. The sweepstakes model of this betting platform provides a great combination of social networking and legal sports betting in the state, without any legal and monetary risks.

References:

About form W-2 g, certain gambling winnings (no date) Internal Revenue Service. Available at: https://www.irs.gov/forms-pubs/about-form-w-2-g (Accessed: 17 October 2023).

State of Texas: Texas Legislative Council (no date) Tlo, TLO. Available at: https://capitol.texas.gov/ (Accessed: 17 October 2023).

Elina Blagoeva is a member of the Mr. Sweepstakes editorial team. She studied Multimedia and Creative Technologies at the KdG University of Applied Science and Arts in Antwerpen, Belgium.